what qualifies for home improvement tax credit

Web Households with income less than 80 of AMI. Web Qualified energy efficiency improvements.

8 Tax Deductions For Homeowners Rocket Mortgage

Web You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

. Households with income between 80-150 AMI. Web Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Deducting Improvements If You Qualify for the Home.

Web The tax credit youre eligible for is a percentage of the cost of alternative energy equipment thats installed on or in a home including the cost of installation. Solar electricity systems solar water heaters small wind turbines and geothermal heat pumps all qualify as a home. Explore more on it.

You are eligible for a 300. Web A tax credit can be applied to 10 of the cost for qualified energy-efficiency improvements as well as the amount of the energy-related property expenditures paid or. Web If your new heater qualifies you may receive up to a 150 tax credit on your federal income tax form.

Web You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs. Web What qualifies as a home improvement for a tax credit. In 2018 2019 2020 and.

If you repaint as part of a larger substantial improvement. Qualifying properties are solar. Web Advanced circulating fans for natural gas propane or oil furnaces.

Web To qualify to depreciate home improvement costs you must use a portion of your home other than as a personal residence. Web Its important to determine your eligibility for tax deductions and tax credits before you file. Two types of tax.

Web Total qualified expenses incurred between January 1 2022 and December 31 2022 in excess of 1000 base amount but not more than 10000 can be claimed on your. Those with an energy factor of 22 or more. People also ask.

Deductions can reduce the amount of your income before you calculate. Web As long as these energy saving improvements qualify homeowners can claim between 10 and 100 of the cost incurred. 30 tax credit up to 150 per year.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and. Web For eligible home improvements after 2024 no credit will be allowed unless the manufacturer of any purchased item creates a product identification number for the item. 30 tax credit up to 150 per.

Energy-efficient home upgrades can make you eligible for a. Web Water heaters non-solar The majority of water heaters qualify for 300. In 2018 2019 2020 and.

TurboTax notes that you can claim a tax. Web Under the previous terms the credit allowed for 10 of the costs of installing energy-efficient insulation windows doors roofing and other energy-oriented. Web For instance if after completing your tax return you owe the IRS 500 introducing a 400 tax credit reduces the amount you owe to 100.

The 300 credit is also available for water.

What Is A Home Improvement Tax Credit With Pictures

Tax Deductions On Home Improvement Projects Taxact Blog

Proposal For Home Improvement Tax Credit To Help Middle Class Families Boost The Economy General Insulation

![]()

Employee Retention Tax Credit For Construction And Home Improvement Service Companies Employee Retention Credit For Construction And Home Improvement Service Businesses 2022 On Vimeo

Home Improvement And Residential Energy Tax Credits For Indiana Residents Service Plus Heating Cooling Plumbing

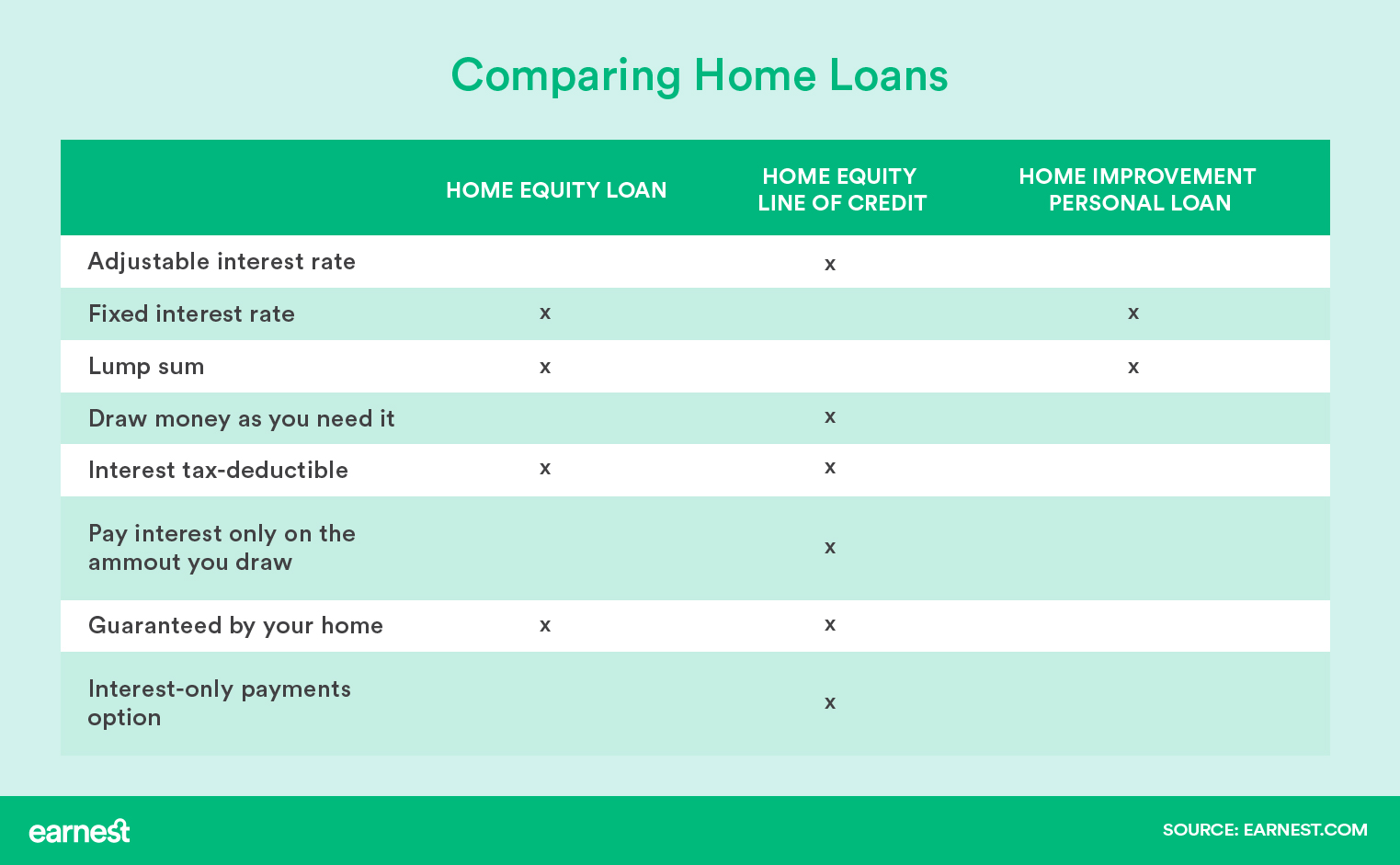

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Tax Deductible Home Improvements For 2022 Budget Dumpster

Tax Deductible Home Improvements For 2022 Budget Dumpster

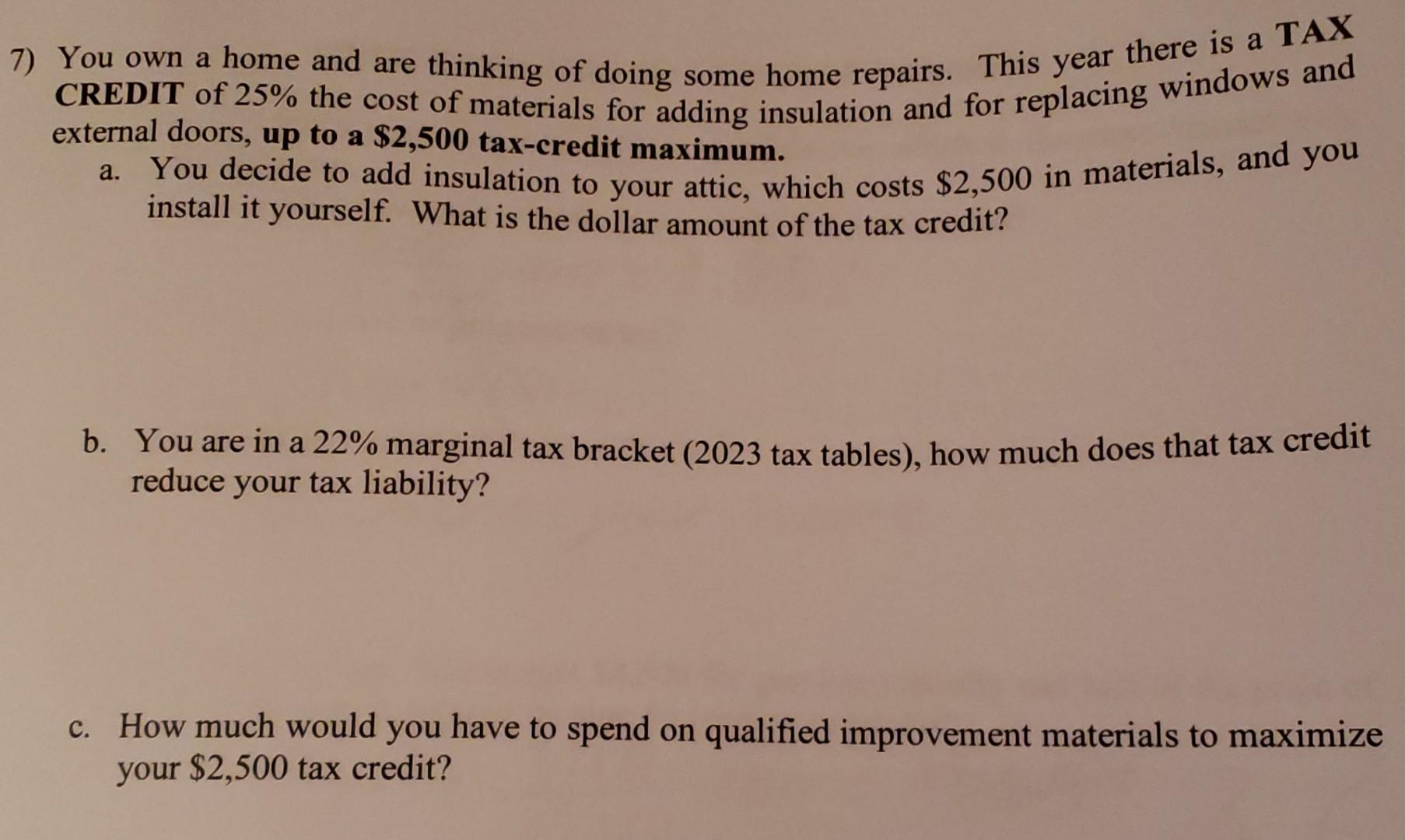

Solved You Own A Home And Are Thinking Of Doing Some Home Chegg Com

4 Home Improvements That Are Potentially Tax Deductible

Home Improvements That Can Pay Off On Your Taxes When You Sell Don T Mess With Taxes

Tax Differences Between Home Repairs Home Improvements Don T Mess With Taxes

2011 Tax Credits For Energy Efficient Home Improvements Like Insulation Windows Doors Heaters Stoves Solar Panels

Montgomery Planning Will Hold Virtual Historic Preservation Tax Credit Open House On March 4 Montgomery Planning

How To Pay For Home Improvements Bankrate

Tax Deductible Home Improvement Repairs For 2022 Walletgenius

Better Than Free Italy Offers 110 Tax Credit For Energy Efficiency Home Improvements Power Integrations Inc

:max_bytes(150000):strip_icc()/GettyImages-551425607-f1c354ae6d184b89a161e714d2ef659b.jpg)